Features

- Added Security with Out of Band Authentication (OOBA) - NEW

- Ability to establish an additional "View Only" user access - NEW

- Text Banking - Using key words for response - NEW

- Mobile Deposit - Auto Capture Check Images - NEW

- Reorder Checks - NEW

- Consistent look and feel across desktop and mobile devices - NEW

- View Account Balances and Transactions

- Transfer Funds

- View Account Statements

- Bill Pay

- Account Alerts by Text or Email

- Stop Payments

What to Expect at Conversion

First Time Login on April 12th - You will be able to login to the new Online Banking via First State Bank's website or by using the mobile app. If you already use the app, you will be prompted on April 12th to update the app before logging in.

First time you login:

- Enter your current Online Banking Username

- Password Entry:

- Personal Customers - Use the last 4 digits of your social security number as your temporary password

- Business Customers - Use the last 4 digits of your business Tax ID Number as your temporary password

- You will be prompted for an Authentication Code by Phone, Text, or Email*

- Once authenticated - select your new password

*Text and Voice are the primary methods for Out of Band Authentication (OOBA). Please verify that you have a valid phone number on file with FSB for future code access.

FAQs

Frequently Asked Questions

How can I prepare?

- Please make sure that your contact information with FSB is up to date. You can verify on the OPTIONS page/Modify Personal Settings after logging into Online Banking.

Why do I need an Authentication Code to login?

- This is an additional security feature to protect your accounts. You can receive the code by text or phone (preferred). Email will be allowed for initial logins at conversion.

Will my Alerts stay the same?

- Some alerts will carry over to the new platform, but due to different options, some may require new setup. Please verify from the new platform. New Alerts will come from 833-372-2265.

Will my Bill Pay stay the same?

- Yes, if you are a current BP user, your payment history, payees, and scheduled payments will continue; however, you will need to accept an updated disclosure.

Will I have to re-enroll in eStatements?

- No, you will continue to receive your electronic statements; however, you will need to accept an updated disclosure.

Can I use my fingerprint and/or face ID to login to the app?

- Yes, after your initial login to the updated app you will be able to enable biometric login.

Will my existing Username/Alias work?

- Yes, your existing Username/Alias will carry over to the new platform. You can change your username by accesssing OPTIONS - Modify Personal Settings.

Do I need to go to a different place to login?

- You will still login via the main page of our website under SECURE LOGINS. On April 12th, this will automatically direct you to our new platform.

Will my QuickBooks/Quicken/Mint connections be affected by this conversion?

- Yes, the upgrade will require you to make changes to your QuickBooks, Quicken, and/or Mint software by taking action on two different dates. Please reference specific instructions on the Quickbooks, Quicken, & Mint tab on this information page.

Business Banking Cash Management

What do I need to do to prepare?

- Please log into your online banking and ensure that your email address and phone numbers are up to date on the “Options” tab. Contact Treasury Management at 940-668-4316 if any questions.

How will I access services previously under the “Cash Manager” Tab?

- All information previously listed under the “Cash Manager” tab will be located under the “Business” tab.

What business services will be listed under the “Business” tab?

- The following sections will be available from the Business tab: ACH Origination, Positive Pay, RDC, Online Wires, and Permissions (formerly User Settings)

Will my existing ACH Origination batches convert?

- Approximately 90 days of "Initiated" batch history will convert. Please save any additional batch history prior to conversion.

Will there be any difference in the ACH Origination process?

- Yes. The Dual Control Process will be slightly different after conversion. Currently, the statuses are Ready and Initiate. After conversion, the status options will be: Available, Initiate Pending and Initiated.

- Available: ACH Batch is new or has been previously processed. This batch is ready to process again. If previously created, a user must click “Authorize” to move this to the next status.

- Initiate Pending: ACH Batch has been authorized by a user and is ready for a second user to initiate. To meet the dual control requirements, this step cannot be done by the same user that authorized the batch.

- Initiated: ACH Batch is initiated. Status is considered complete at this time. Once initiated, the SEND date and EFFECTIVE date should display in their respective columns on the screen. The batch will display as Available after the batch has processed.

Will my existing token for Cash Management still work?

- No. We will be replacing existing tokens with a new DUO virtual or hard token. Some Cash Management users may no longer need a token if they do not have "send funds" access.

Will users be able to login with the same username as they had prior to conversion?

- Yes. The new Online Banking platform will require a one-time setup. The new system will allow users to enter the same Online Banking username from the previous system. The temporary password will be the last 4 digits of the business tax id number. You will be required to set up a new password.

Will Cash Management User Permissions remain the same?

- Yes, user information and user permissions will convert; however, there may be some differences with our new platform. We recommend that the ADMIN review user access at the time of conversion to make any needed updates.

Is anything changing with Business Bill Pay?

- No. If you are already enrolled for Business Bill Pay, your payees and recurring payments will convert.

Is anything changing with RDC?

- No. If you are already an RDC user, your history and settings will continue in the new platform.

Will my Wire PIN be the same for Online Wires?

- You will no longer be required to enter a Wire PIN. Online Wire customers will be required to utilize the new “Out of Band Authentication” as well as the DUO token when transmitting wire transfers to the bank.

Will there be any difference in Positive Pay?

- Previously uploaded items will convert. Please continue to work exception items. After conversion an automatic alert notification will be sent regarding exception items via email at approximately 7:00 a.m. daily. To opt out of this notification, please contact Treasury Management at 940-668-4316 .

Will my QuickBooks/Quicken/Mint connections be affected by this conversion?

- Yes, the upgrade will require you to make changes to your QuickBooks, Quicken, and/or Mint software by taking action on two different dates. Please reference specific instructions on the Quickbooks, Quicken, & Mint tab on this information page.

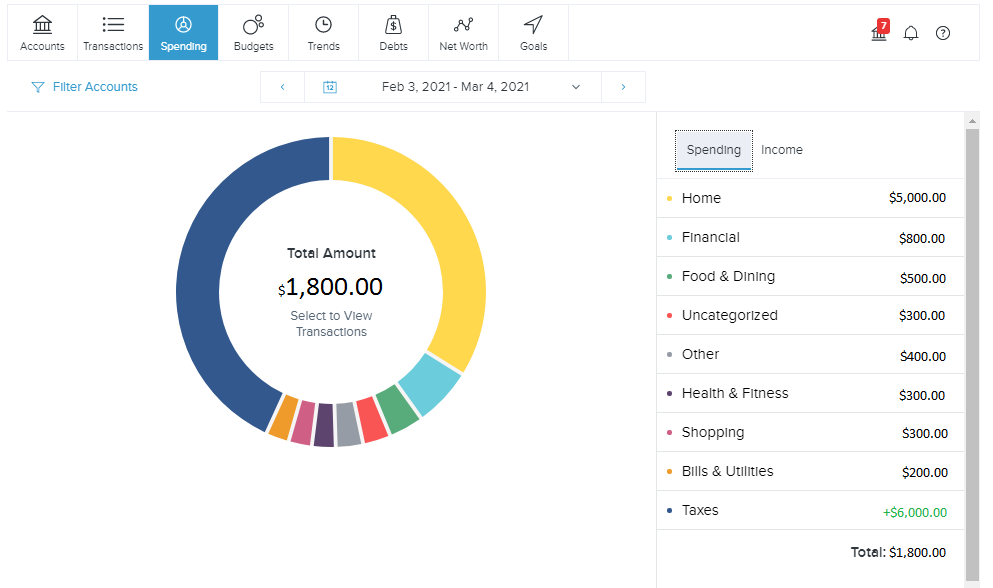

Money Desktop

Money Desktop

Your Personal Financial Management Tool

Money Desktop provides a seamless experience for all your financial data in a single platform. Track your spending, create and manage budgets, add accounts from other financial institutions and setting financial goals are just a few of the ways the Money Desktop tool allows you to experience financial wellbeing.

Quickbooks, Quicken, & Mint

First State Bank’s Online Banking upgrade will require you to make changes to your QuickBooks, Quicken, and Mint software. Please reference the two important dates below:

1st Action Date: April 9, 2021

A data file backup and a final transaction download should be completed by this date. Please make sure to complete the final download before this date since transaction history might not be available after the upgrade.

2nd Action Date: April 12, 2021

This is the action date for the remaining steps on the conversion instructions. You will complete the deactivate/reactivate of your online banking connection to ensure that you get your current Quicken or QuickBooks accounts set up with the new connection.

Conversion Instructions:

QuickBooks Online

QuickBooks Desktop

Quicken

Mint

Please carefully review your downloaded transactions after completing the migration instructions to ensure no transactions were duplicated or missed on the register.